2022 Outlook, 2nd Half

Greetings,

As we enter the second half of 2022, I remain confident that we will see an economic slowdown and home prices begin depreciating. Below is my reasoning for my prediction.

A Repeat of 2008

As I speak with many friends and clients, it's worrisome that many believe homes will continue to boom. We have seen homes appreciate like never in history. The Federal Reserve Bank of Dallas recently sounded the alarm and stated the U.S. housing market behavior has become abnormal for the first time since the boom of the early 2000s. The Dallas Fed now believes that fear of missing out (FOMO) has kicked in, which I stated in my 2022 Q1 Outlook. These are the buyers I genuinely worry for. The ones who are being misguided and told, "now is the time to buy."

The Federal Reserve, Interest Rates, Layoffs

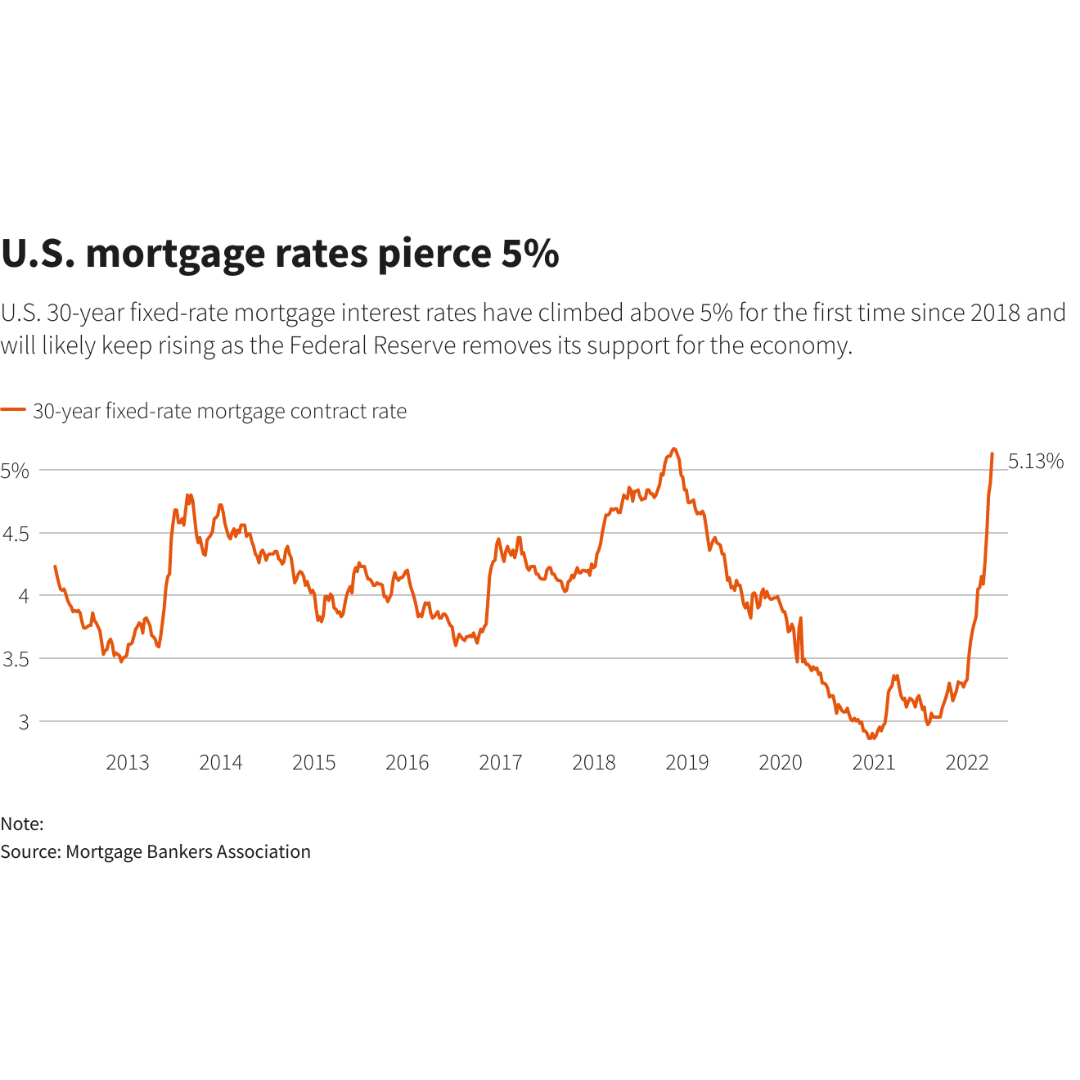

Interest rates have swiftly climbed since March. Chairman Jerome Powell of the Federal Reserve has indicated he will continue to increase interest rates until inflation comes down. While the latest interest rate increases seem to have slightly slowed the number of buyers, sellers are still getting top dollar for their homes. On May 10, 2022, Powell reiterated that he intends to increase mortgage rates in June and July. If you have any intention of refinancing or are committed to purchasing now, you should do so as soon as possible. We will see interest rates near 7% before the 3rd quarter.

Additionally, the sudden number of banks laying off employees is concerning. Rocket Companies, the largest lender in the mortgage industry, announced they would be laying off approximately 2,000 employees. Better.com just announced its third round of layoffs, which has affected over 4,000 employees since December 2021. Wells Fargo has also announced that an undisclosed number of employees will soon be laid off. These are all indicators that turbulent times are ahead for the mortgage industry.

Wallstreet

The three major indexes, Dow Jones, NASDAQ, and S&P500, have all taken a beating in 2022, with the NASDAQ leading the decline by more than -23%, putting it officially in a "bear market." Amazon dropped -15% after its earnings announcement, losing approximately $180 billion in valuation, its largest decline since 2006. The Cboe Volatility Index, aka the VIX, is a market index representing the market's expectations for volatility over the coming 30 days. Many use the VIX to measure fear in the market. Since 1990, the VIX has hit an average level of 37 at market bottoms. In general, a VIX reading below 20 suggests low economic risks. Currently, the VIX has been in the low 30s.

Bank of America posted an interesting fact about the S&P, stating, "Over the past 11 recessions, the S&P declined between 14% and 57% peak to trough, at an average of 27.5%". On Thursday, May 12, 2022, the S&P dropped 20% before recovering to 18% on Friday.

An essential tool indicating an incoming recession is the yield curve. The US curve had inverted before each recession in the past 50 years and offered a false signal just once. On April 1, 2022, it inverted for the first time since 2019. Before 2019, the last time it inverted was in 2007, approximately 12 months before the 2008 crash. When the 2yr/10yr yield invert, it's typically an indicator that a recession is less than 24 months away.

Oil Prices & Inflation

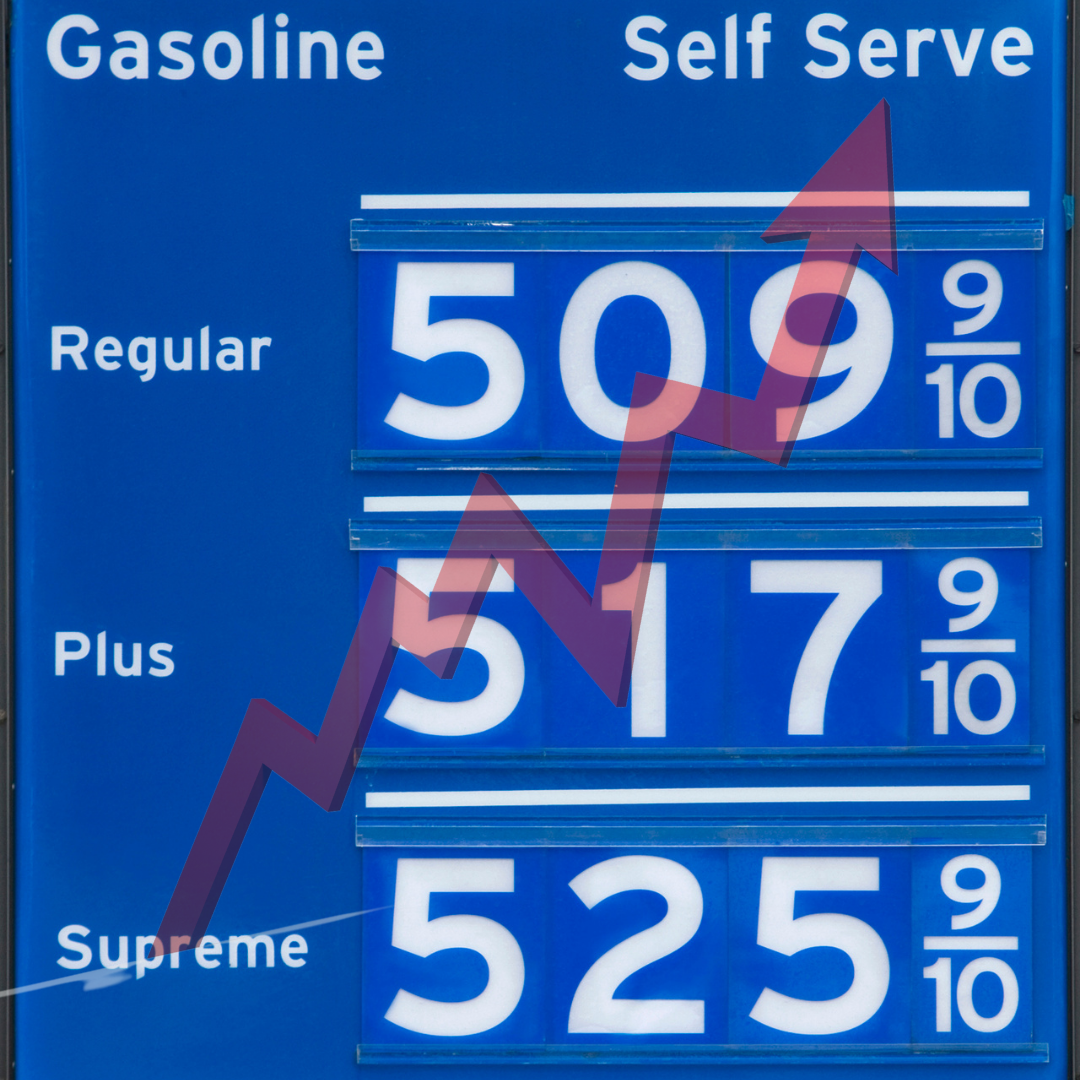

On March 2022, the Consumer Price Index, which measures the prices paid by consumers, hit a 40-year high, peaking at 8.5% annually. This is the fastest pace since December 1981. Oil has also significantly gone up since the first half of the year, with the average cost for a barrel currently around $110. It was previously higher but slightly dropped due to strict COVID lockdowns in China. I believe once China rescinds the lockdowns, a barrel of oil may exceed $150.

On March 8, 2022, Elon Musk, a strong advocate for clean energy, Tweeted, "Hate to say it, but we need to increase oil & gas output immediately. Extraordinary times demand extraordinary measures." On Wednesday, May 4, 2022, JP Morgan's CEO Jamie Dimon stated, "Global energy is precarious...If oil goes to $185, that's a huge problem for people, and we should do everything we can today. We need to pump more oil and gas." The following week, the Biden administration canceled oil drilling lease sales in the Gulf of Mexico and Alaska's Cook Inlet. The decision comes at a time when the price for a gallon of gas continues resetting all-time highs, according to AAA. For the first time in US history, all 50 states are averaging over $4 a gallon of gas. Diesel prices have also set a new all-time high at $5.55 per gallon at a national average.

The President is now faced with a tough decision; keep his promise of doing away from fossil fuels or does he put it on the back burner and begin drilling to bring down the cost of fuel?

Corelogic, a major US real estate research group, released a study that suggests 65% of all housing markets are disconnected from fundamentals.

According to Black Knight, a mortgage payment now costs 31% of the typical American household income. That's up from 24% in December and the highest share since 2007. The new data shows Americans struggling with higher costs as mortgage rates surge.

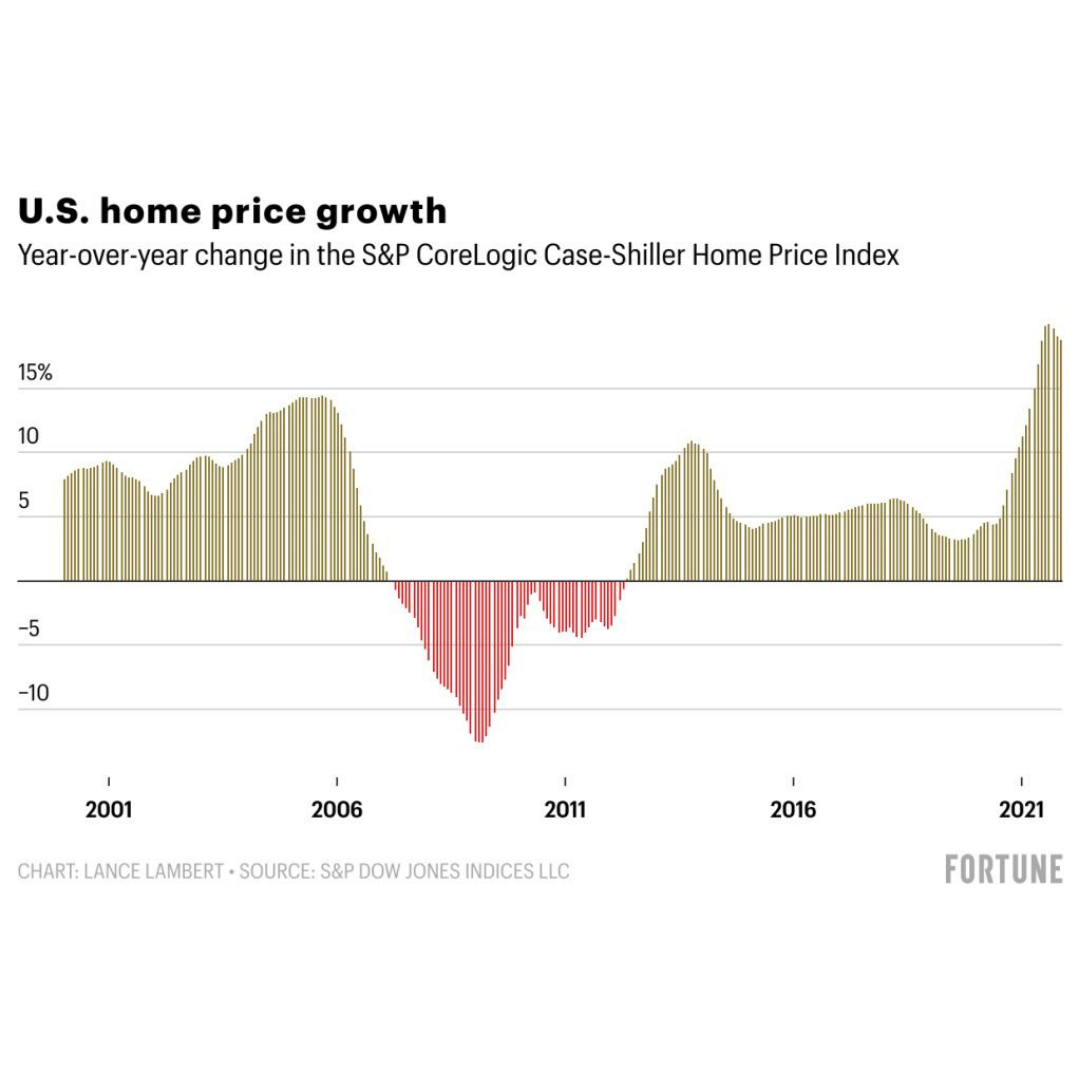

In the years leading to the 2008 housing crash, the highest year-over-year (YOY) increase in home prices was 14.5%. We shattered that record with 20% YOY increases. However, many people still believe these increases are normal, in particular South Florida. They think that home prices will remain elevated due to the rise of people flocking to Florida. The issue is that this is a nationwide problem, not a Florida problem.

Situational Awareness:

We need to continue monitoring the Ukraine war. As long as the war continues, oil and commodities will remain high. A bigger concern for me is the tension between Taiwan and China, which many people are naive about. In recent weeks, tensions between both countries have escalated, and many believe an invasion by China is imminent. On May 6, China deployed 18 fighter jets into Taiwan's air defense zone, prompting Taiwan to scramble fighter jets. This was the second-largest encroachment on Taiwan's airspace so far this year.

I'm convinced China is trying to prompt an attack by Taiwan to initiate a war between both countries. If this were to occur, it would be catastrophic to the global economy.

Conclusion

Since the beginning of May, I have noticed an increase in listings and price reductions. I believe the bubble has burst. Unfortunately, inflation has run wild, and the government has failed to address it promptly.

On Thursday, May 12, 2022, Jerome Powell was confirmed by the Senate for his second term. During his speech, he warned everyone stating, "A soft landing is, is just getting back to 2% inflation while keeping the labor market strong. And it's quite challenging to accomplish that right now for a couple of reasons. It will be challenging; it won't be easy. No one here thinks that it will be easy. Nonetheless, we think there are pathways for us to get there." On Tuesday, May 17, 2022, Powell reiterated his stance on controlling inflation, stating he will continue raising interest rates until inflation is tamed. I agree with Powell that there is a pathway to getting inflation under control, but it won't be without an economic collapse.

I caution all buyers, in particular those purchasing a starter home. It took years for some to recover from the 2008 collapse. This may be when you want to sit on the sidelines and save cash. If you are looking for your "forever" home, you are in a safer position since most of those buyers do not intend to sell for many years. If you are considering selling, we are at the peak. The time to sell is now. Do not get greedy.

I hope this helps you make a better-informed decision regarding real estate. When debating if you should buy now or wait, ask yourself, is the appreciation homes have experienced over the last 18 months normal? If you think it is, then buy. If you have doubt, stick to your instinct.

Categories

Recent Posts

![It’s Still a Sellers’ Market [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20220404/16/w600_original_1b3ec1b1-87d3-46a7-9617-d3c71eac0ff2-png.webp)

![What’s Driving Today’s High Buyer Demand? [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20220221/16/w600_original_0769980d-2582-4864-9c7e-7aa1fff09550-png.webp)

GET MORE INFORMATION